What Makes an Offshore Trust an Effective Tax Strategy Tool?

What Makes an Offshore Trust an Effective Tax Strategy Tool?

Blog Article

The Role of an Offshore Count On in Effective Estate Planning Methods

Offshore counts on are significantly identified as an essential component of effective estate preparation methods. They provide one-of-a-kind benefits such as asset security, tax obligation advantages, and improved privacy. By separating possession from control, individuals can guard their wide range from possible creditors and legal difficulties. The complexities surrounding offshore trusts can elevate concerns concerning their application and effectiveness - Offshore Trust. Checking out these ins and outs exposes insights that could meaningfully affect one's monetary legacy

Understanding Offshore Trusts: A Detailed Introduction

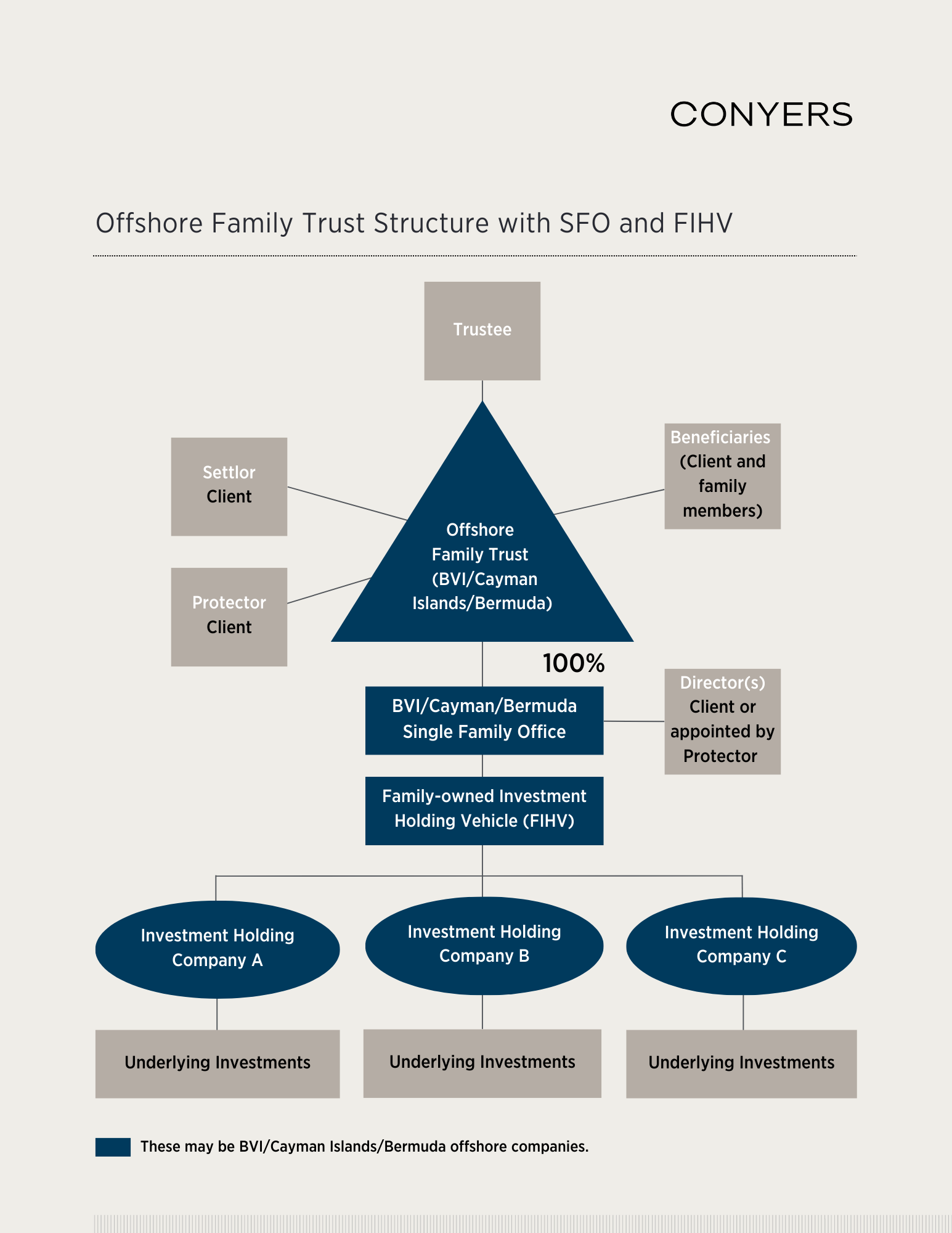

Offshore depends on offer as tactical monetary instruments in estate planning, designed to secure possessions and supply tax benefits. These trusts are developed in jurisdictions outside the settlor's home nation, commonly featuring desirable legal frameworks. Commonly, people use offshore depend secure riches from political instability, economic slumps, or potential lawsuits.The core framework of an offshore count on includes a settlor, that creates the depend on; a trustee, in charge of handling the properties; and recipients, who benefit from the depend on's possessions. This separation of possession and control can boost possession defense, making it a lot more difficult for creditors to claim those assets.Additionally, offshore trust funds can facilitate estate planning by guaranteeing a smooth transfer of wide range throughout generations. They supply adaptability regarding property monitoring and circulation, allowing the settlor to customize the trust according to personal desires and household demands. This customization is vital for long-lasting economic security and family members legacy.

The Tax Benefits of Offshore Trusts

Offshore depends on offer considerable tax benefits, mostly via tax deferral benefits that can boost wealth preservation. By strategically positioning properties in jurisdictions with positive tax legislations, individuals can successfully protect their wealth from higher taxes (Offshore Trust). Additionally, these depends on act as a durable asset protection technique, securing properties from creditors and lawful insurance claims while maximizing tax performance

Tax Obligation Deferral Conveniences

Usually neglected, the tax obligation deferral advantages of counts on developed in international territories can play a vital role in estate planning. These counts on frequently allow individuals to delay taxes on income generated by the depend on possessions, which can bring about considerable increases in wealth accumulation over time. By holding off tax responsibilities, clients can reinvest incomes, enhancing their general monetary development. Furthermore, the particular tax obligation policies of various overseas jurisdictions may supply chances for further tax optimization. This critical benefit makes it possible for individuals to align their estate planning goals with long-term economic objectives. Ultimately, understanding and leveraging the tax obligation deferral advantages of offshore counts on can considerably enhance the effectiveness of an estate plan, ensuring that riches is preserved and optimized for future generations.

Asset Protection Techniques

Tax advantages are just one element of the benefits that offshore counts on can provide in estate planning. These trusts work as robust possession security approaches, securing possessions from possible lenders and legal cases. By moving assets into an offshore trust, people can develop an obstacle that makes complex creditors' accessibility to those properties. This is particularly beneficial in territories with desirable depend on regulations, giving an additional layer of security. Additionally, offshore trusts can safeguard wide range versus unpredicted circumstances, such as suits or divorce settlements. They additionally make it possible for people to keep control over their possessions while ensuring they are secured from exterior threats. Ultimately, the tactical use overseas depends on can boost both economic security and estate planning efficiency.

Asset Defense: Guarding Your Wealth

Privacy and Privacy in Financial Affairs

In the domain name of estate planning, preserving privacy and privacy is a considerable concern for many individuals. Offshore trust funds serve as an effective tool to accomplish these objectives, as they can effectively shield monetary affairs from public analysis. By positioning assets in an offshore count on, individuals can reduce the threat of undesirable direct exposure to their wide range and financial strategies.The inherent attributes of overseas counts on, such as rigid privacy regulations and policies in particular territories, boost confidentiality. This suggests that details concerning the trust's possessions and recipients are typically stayed out of public records, safeguarding sensitive information.Moreover, using an offshore trust can assist alleviate threats connected with prospective legal conflicts or lender claims, further promoting economic personal privacy. On the whole, the critical application of overseas trusts can significantly strengthen an individual's monetary privacy, enabling them to manage their estate in a very discreet manner.

Selecting the Right Territory for Your Offshore Depend on

When thinking about the perfect jurisdiction for an overseas depend on, what elements should be focused on? First and foremost, the lawful framework of the jurisdiction is important. This consists of the trust legislations, property security laws, and the general stability of the legal system. A jurisdiction with distinct regulations can provide improved safety and security and enforceability of the trust.Another important factor to consider is tax effects. Territories differ substantially in their tax obligation treatment of overseas counts on, which can influence the general performance of the estate planning approach. Additionally, a desirable regulatory atmosphere that advertises personal privacy and privacy should be evaluated, as this is frequently a crucial motivation for developing an offshore trust.Finally, access and administrative demands are crucial. Territories with effective procedures and specialist services can facilitate simpler monitoring of the trust fund, guaranteeing that it meets the grantor's goals and adheres to compliance demands.

Usual Misunderstandings About Offshore Trusts

What are the common misconceptions bordering overseas trust funds? Several people incorrectly think that offshore trust funds are only for the ultra-wealthy, thinking they are solely devices for tax obligation evasion. Actually, offshore counts on can serve a diverse series of estate preparation requires, profiting people of numerous financial backgrounds. Another common mistaken belief is that these counts on are unlawful or unethical; however, when established and handled appropriately, they adhere to global legislations and guidelines. Additionally, some people fear that overseas depends on lack security from lenders, yet specific jurisdictions provide durable lawful safeguards. There is likewise a belief that managing an overseas count on is costly and excessively complex, which can discourage prospective customers. In fact, with proper support, establishing and preserving an overseas depend on can be extra straightforward than anticipated. Dealing with these misunderstandings is essential for people considering overseas counts on as part of their estate preparation method.

Actions to Establishing an Offshore Trust Fund for Estate Preparation

Establishing an overseas trust fund for estate planning entails several critical actions. First, people need to select an ideal jurisdiction that straightens with their financial and legal objectives. Next off, selecting the best trust fund possessions and preparing a comprehensive trust document are important to guarantee the trust runs efficiently.

Selecting the Jurisdiction

Choosing the ideal jurisdiction for an offshore trust fund is vital, as it can greatly affect the depend on's effectiveness and the protections it provides. Factors such as political security, legal structure, and tax regulations must be thoroughly reviewed. Territories recognized for solid possession defense laws, like the Chef Islands or Nevis, are typically favored. Additionally, the simplicity of establishing and maintaining the count on is vital; some areas use structured procedures and fewer administrative obstacles. Access to neighborhood lawful knowledge can also impact the choice. Ultimately, the chosen territory must line up with the grantor's particular objectives, ensuring maximum benefits while lessening dangers linked with regulative changes or administrative restrictions.

Selecting Trust Assets

Choosing the ideal properties to position in an offshore count on is a crucial action in the estate preparation process. Individuals must meticulously evaluate their assets, including money, financial investments, property, and service passions, to determine which appropriate for addition. This evaluation ought to consider elements such as liquidity, prospective growth, and tax obligation effects. Diversification of possessions can boost the depend on's stability and ensure it satisfies the recipients' needs. In addition, it is important to make up any type of lawful restrictions or tax responsibilities that might develop from moving specific possessions to the overseas count on. Eventually, a well-thought-out choice of depend on possessions can greatly influence the effectiveness of the estate plan and safeguard the customer's yearn for property circulation.

Preparing the Depend On Paper

Preparing the trust fund paper is an important action in the creation of an overseas trust for estate preparation. This file describes the particular terms and problems under which the trust fund operates, detailing the duties of the trustee, recipients, and the circulation of possessions. It is necessary to clearly specify the objective of the trust and any kind of terms that may apply. Lawful needs might vary by jurisdiction, so speaking with an attorney experienced in offshore trust funds is important. The document should also address tax implications and asset defense approaches. Effectively implemented, it not just safeguards assets yet additionally assures compliance with worldwide legislations, eventually helping with smoother estate transfers and decreasing potential conflicts among recipients.

Frequently Asked Inquiries

Exactly How Do Offshore Trusts Affect Probate Processes in My Home Country?

Offshore trusts can substantially affect probate procedures Your Domain Name by possibly bypassing neighborhood administrative laws. They may secure possessions from probate, reduce tax obligations, and improve the transfer of riches, inevitably resulting in a much more effective estate settlement.

Can I Be a Beneficiary of My Very Own Offshore Depend on?

The inquiry of whether one can be a beneficiary of their very try this website own overseas depend on usually occurs. Typically, people can be called beneficiaries, yet certain regulations and effects may differ depending on territory and trust structure.

What Happens if I Relocate To Another Nation After Developing an Offshore Count On?

If an individual transfer to an additional country after developing an overseas count on, they might encounter differing tax obligation effects and lawful policies, possibly impacting the count on's monitoring, circulations, and reporting responsibilities according to the brand-new jurisdiction's laws.

Are Offshore Depends On Suitable for Tiny Estates?

Offshore trusts may not be appropriate for tiny estates due to high arrangement and maintenance expenses. They are normally a lot more advantageous for larger properties, where tax advantages and property protection can validate the expenses entailed.

What Are the Prices Connected With Maintaining an Offshore Depend On?

The costs related to maintaining an offshore depend on normally include legal fees, management expenditures, tax obligation compliance, and prospective trustee costs. These prices can vary significantly based upon the complexity and territory of the trust fund. Commonly, individuals utilize offshore depends on to secure wide range from political instability, financial downturns, or potential lawsuits.The core framework of an offshore count on involves a settlor, who creates the trust fund; a trustee, accountable for handling the properties; and recipients, that profit from the trust fund's properties. By positioning wide range within an overseas depend on, individuals can protect their possessions versus suits, separation settlements, and various other unforeseen liabilities.Offshore depends on are normally controlled by the legislations of territories with positive asset defense laws, offering enhanced safety and security compared to domestic options. By positioning properties in an overseas trust, individuals can lessen the risk of undesirable direct exposure to their wide range and economic strategies.The intrinsic attributes of overseas trust funds, such as stringent personal privacy regulations and laws in particular jurisdictions, improve confidentiality. Choosing the appropriate jurisdiction for an offshore trust fund is essential, as it can considerably useful source impact the count on's performance and the protections it provides. Composing the depend on record is an important action in the production of an offshore count on for estate preparation.

Report this page